When it comes selling, designing and installing outdoor technology, integrators find themselves facing a number of challenges that are particularly unique to outdoor projects. However, all of those hurdles are worth the headaches as the market for outdoor audio, video, lighting, security and networking equipment continues to flourish.

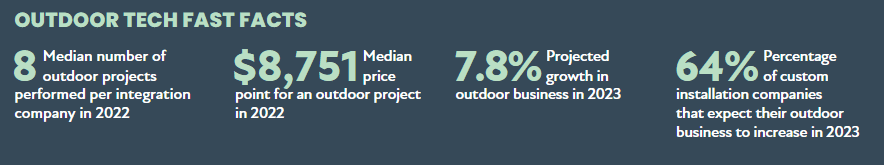

For dealers the super-high price premiums they were able to charge spurred by the pandemic in 2021 has waned, but the demand for outdoor living installations remains. According to the 2023 CE Pro Outdoor Technology Study, integrators performed a median number of eight outdoor installations in 2022. That is up slightly from seven installations in 2021.

According to the 2023 CE Pro State of the Industry Study, the median number of residential installations last year was 50 per company, so that means 16% of all projects in 2022 had an outdoor living component attached to them.

From a pricing perspective, the median price per outdoor project came back to earth (pun intended), hitting a price point of $8,751. That is on par with the pre-pandemic median installation costs of $7,034, but a far cry from the uber-demand median price point of $13,125 dealers were able to command during the pandemic while the supply chain situation was out of whack.

As every integrator knows, the demand spike for outdoor projects after COVID-19 hit was through the proverbial roof as clients sought entertainment options in fresh, open-air outdoor living spaces. But now that the panic-driven hype surrounding coronavirus has subsided, clients are less willing to shell out higher amounts of money to put their project at the top of the installation schedule. Meanwhile, there are more product options from which to choose – both high end and entry-level – giving integrators even more flexibility in pricing.

The Future of Digital Lighting & Control

As a custom integrator, lighting is in demand. Effective communication, education and showcasing the value proposition of LED light fixtures in conjunction with integrative control systems are the keys to overcoming challenges and closing sales in this specialized market. Join us as we discuss the future of digital lighting and control with David Warfel from Light Can Help You and Patrick Laidlaw and Mark Moody from AiSPIRE. Register Now!

That’s not dampening the mood of integrators in the slightest, however. In 2023, CE pros are expecting their outdoor business to continue to thrive, with a 7.8% average revenue growth rate predicted for this year. Nearly half of all integrators (44%), anticipate their average price per outdoor installation will rise in 2023.

One reason for the strong growth of the outdoor tech category is that integration companies are discussing outdoor solutions with their clients as an extension of the interior of the home versus as a standalone system. According to the study, 60% of all outdoor installations are part of a project that includes a technology solution inside the home already.

That means from a control standpoint, the outdoor AV is seen simply as an additional zone. Nearly one out of every four integrators (23%) said that every exterior project they completed in 2022 was linked to a system in the home’s interior.

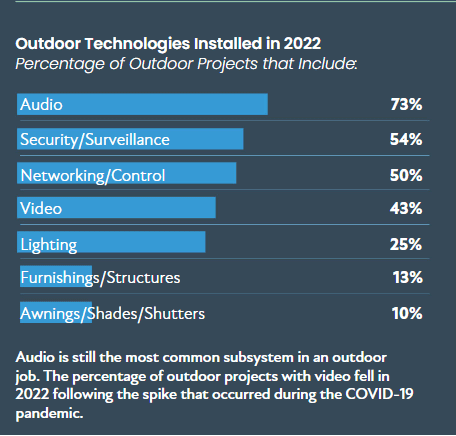

In terms of what technologies are being installed outside, audio is the big kahuna. Nearly three out of every four (73%) outdoor projects included an audio solution last year. Security/video surveillance was the next most common outdoor category, with 54% of exterior projects including some form of exterior security, whether that be cameras, automated security lighting, or perimeter security detection.

The ability to use the wireless home network while in the backyard has become of utmost importance, and that is confirmed in the data. Exactly half of all outdoor installations included exterior wireless access points. The advent of outdoor displays has allowed the backyard video market to remain strong. In all, dealers report 43% of their exterior installations had video, whether that is poolside, on the patio, in the outdoor kitchen, etc.

Not too many years ago, very few integrators delved in the landscape lighting field, but integrators now install landscape lighting in one-fourth of all their outdoor projects. Furnishings/structures such as smart pergolas, grills, motorized insect screens, heaters and other amenities are in 13% of outdoor jobs, while exterior motorized shades are found in 10% of outdoor living projects last year.

Outdoor Audio Remains King

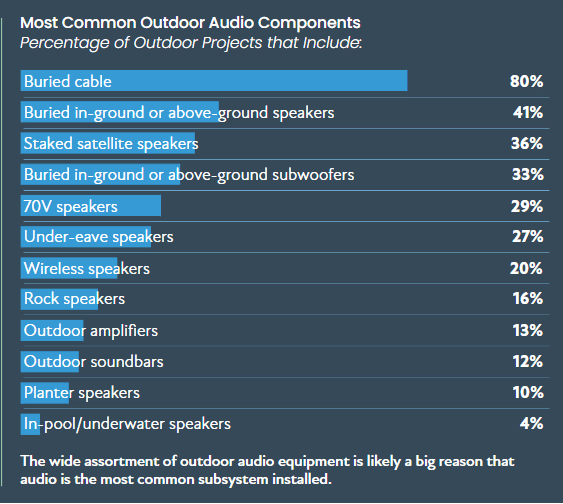

As noted, audio is the king of outdoor technology. One reason might be the diverse types of audio solutions that dealers can deploy. Of course, the most-common task associated with outdoor audio is burying cable. Eight out of every 10 outdoor projects involve burying cable.

Looking at the on the flip side, it means one in five outdoor installations is wireless. That high number shows the growing prevalence of wireless solutions on the market from companies like Sonos, JBL, OSD and others.

Buried in-ground (41%), staked (36%), and under-eave-mounted (27%) speakers, along with above-ground subwoofers (33%), are the most common exterior speakers being installed in outdoor living areas. Also, 70V speakers are installed in 29% of outdoor jobs.

Other types of outdoor speakers used include rock speakers (16% of outdoor projects), planter speakers (10%) and in-pool/underwater (4%). In 13% of outdoor projects, amplifiers are used. Outdoor soundbars are also becoming somewhat prevalent, with 12% of projects including an outdoor theater with a soundbar.

Of course, integrators are never shy in sharing ideas for possible equipment improvements, so when CE Pro asked in 2023 Outdoor Technology Deep Dive Study if dealers had any suggestions about possible new outdoor audio solutions manufacturers could develop, the ideas came pouring in.

Here are just some of the recommendations CE pros would like to see manufacturers of outdoor audio gear make:

- Improved reliability of color endurance and more color options.

- Smaller in-ground subwoofers.

- Modular-style satellite speakers.

- Premanufactured custom TV enclosures.

- Weatherproof baluns and other additional accessories.

- Improved design aesthetics that incorporate LED technology.

- Solar-powered outdoor audio systems.

- Higher SPL for outdoor speakers.

- Hybrid indoor/outdoor enclosures.

- Easier adjustment for fine-tuning the positioning of the speakers after installation.

- More waterproof control options.

- Winter covers.

- Easier connectors for the speakers.

- More 70V speaker products.

- Improved weatherproofing.

- Direct Bluetooth connectivity and Bluetooth extenders

- Outdoor line arrays.

- Speakers with lights built into them.

- More wireless outdoor speakers.

- Rain guards to protect the speakers.

Outdoor Video, Lighting Gain Ground

Outdoor video returned to a state of normalcy in 2022. In 2021, there was a huge spike in the deployment of exterior video solutions, but that spike has waned. Once again dealers are predominantly specifying and installing outdoor TVs at a rate of six times more than they installed outdoor projection technology.

Indeed, 42% of all outdoor living projects included TVs/displays, while just 7% were projectors. Bigger was certainly better also, with dealers reporting 14% of their projects including TV displays larger than 80 inches diagonally.

Mounts (for both projectors and for TVs) remain the most commonly installed outdoor video product, with 48% of all video projects including a mount. Other outdoor technologies deployed include TV enclosures (9%), satellite dishes (11%), OTT antennae (8%) and screens (8%). Something to keep an eye on is the deployment of massive outdoor displays, either in the form of videowalls or outdoor LEDs like C-SEED.

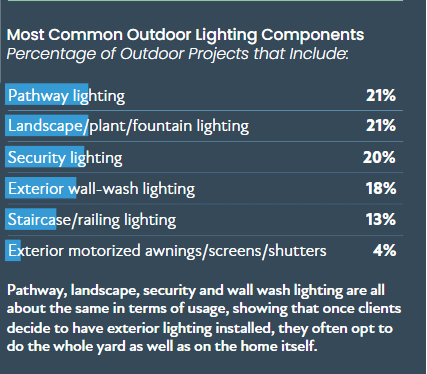

Landscape lighting has also become an illuminating category for many integrators, as noted earlier with one out of every four outdoor projects including lighting. Lighting for pathways (21% of outdoor installations) is the most popular, followed closely by landscape/plant/tree lighting (20%), security lighting (19%), wall wash lighting (18) and staircase lighting (13%).

In terms of other technologies dealers are deploying that have not been previously mentioned, exterior motorized shades/awnings, outdoor heaters, protective heat screens/bug screens, weather stations, pool and spa controls, cell phone signal boosters, and irrigation control systems are all represented in integrators’ portfolios of business when working with outdoor living spaces.

Explaining the Challenges to Clients

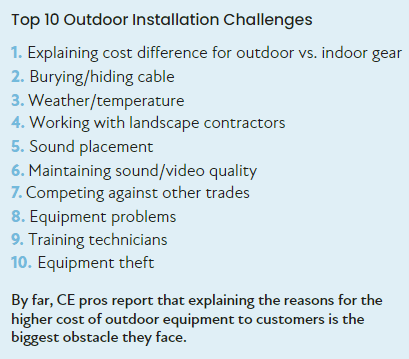

When asked to describe the most challenging part of selling and deploying outdoor technology, dealers note by far the most difficult part is how to explain the cost difference for outdoor equipment versus indoor gear. This is a particularly challenging situation when it comes to outdoor TV displays, which can cost four to five times as much as an indoor TV of the same dimensions. The ability of a CE pro to educate the customer about the IP rating, brightness, glare mitigation in full sun or partial sun, and potential lifespan of an outdoor TV compared to its indoor brethren is vital.

A smattering of survey respondents noted:

“Lack of price awareness is our biggest problem.”

“Our biggest challenge for me is clients thinking the wireless product they buy at Best Buy is just good enough.”

“Client reluctance to spend on these zones is an obstacle. Product selection for pricing and budgeting can be tough.”

The second biggest challenge dealers report facing is burying the cable. Integrators commented:

“Getting our cables cut is common.”

“When retrofitting wiring, it’s sometimes difficult to cross over hardscape walkways and structures, so this can limit the design options.”

Also high on the list of challenges is dealing with the outdoor contractors with whom they usually do not engage on indoor projects. The familiar electricians, architects and interior designers who are common partners on an indoor project are replaced by landscapers, landscape architects, and concrete/pool contractors in outdoor jobs. For many of those tradespeople, technology is alien.

“The biggest challenge is working with the hardscape contractors and architects to make changes for the video and audio portions. They are often only dealing with the design provided, and the client does not want to see any of the technology, but still wants the performance on a budget.”

Also, outdoor projects have different timetables, especially when weather disruptions are possible. Dealers noted:

“Just working with the landscape guys on timing is a concern.”

“Having to wait a lot of time between sales and install, sometimes with only the down payment can be worrisome.”

Another challenge dealers report facing that is somewhat unique to outdoor work is the high rate of equipment theft that can occur mid-installation. With swarms of contractors on a new home construction project, it’s easy for gear to “get legs” and disappear.

Another unique problem is infrequent use of the system by homeowners, who might go all winter not using their outdoor entertainment and then forget how to use the system come spring. That means an additional training visit often months after the job was completed.

Several respondents indicated they are still facing supply chain shortages for their outdoor equipment. Lastly, dealers noted the design of both the products themselves and systems can be a headache. Respondents noted:

“Designing the outdoor area is a big challenge. We started installing outdoor kitchens. We include shared revenue with our builders. The placement of the pre-plumbs is sometime challenging. This exciting category has allowed conversations with builders that we have not always been able to get in front of for our custom integration [low-voltage] side.”

“Outdoor wireless access points tend to be an eyesore.”

“Color choice is a problem. architects want devices to match facades. Manufacturers don’t often offer custom factory painting or warranty on self-painted products.”

“Finding locations that are agreeable to the client is a challenge.”

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our digital newsletters!